Shadow payroll without the chaos.

A single platform for accurate expatriate tax and shadow payroll calculations.

From hypo tax to gross-ups and shadow payroll, calculations are consistent, payroll-ready and delivered without spreadsheets, hand-offs or last-minute pressure on payroll teams.

Trusted by leading tax and mobility providers

What Certino delivers

Certino gives you transparent, repeatable results for expatriate tax and shadow payroll calculations, so complex global payroll runs with control, not guesswork.

-

End-to-end calculation ownership

Certino produces accurate, monthly expatriate tax and shadow payroll calculations - not estimates - that payroll teams can rely on with confidence.

-

Built to sit upstream of payroll

Certino integrates with existing payroll and tax providers, supplying consistent, payroll-ready outputs without disrupting established processes.

-

One place for complex global tax rules

By centralising expatriate tax, hypothetical tax, gross-ups and shadow payroll calculations in a single global platform, Certino reduces compliance risk and removes spreadsheet-driven hand-offs.

-

Designed to support partners

Certino works alongside tax, payroll and mobility providers, giving them a shared calculation layer they can trust across countries and clients.

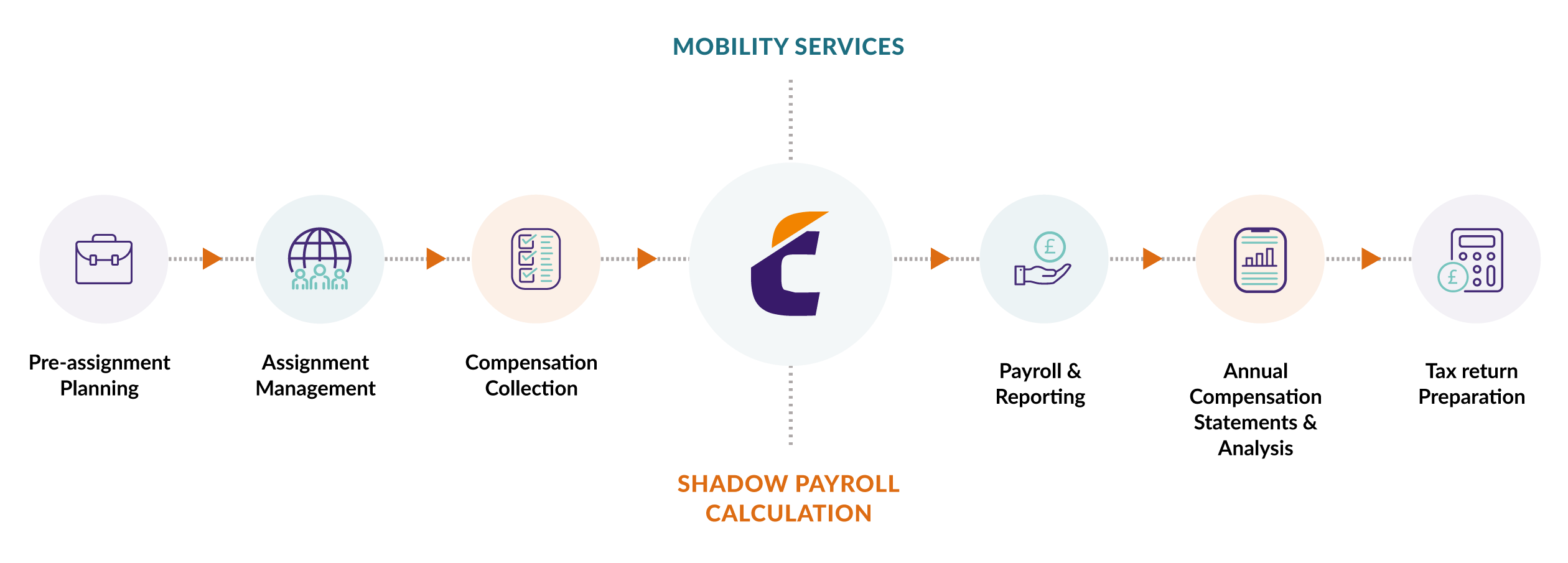

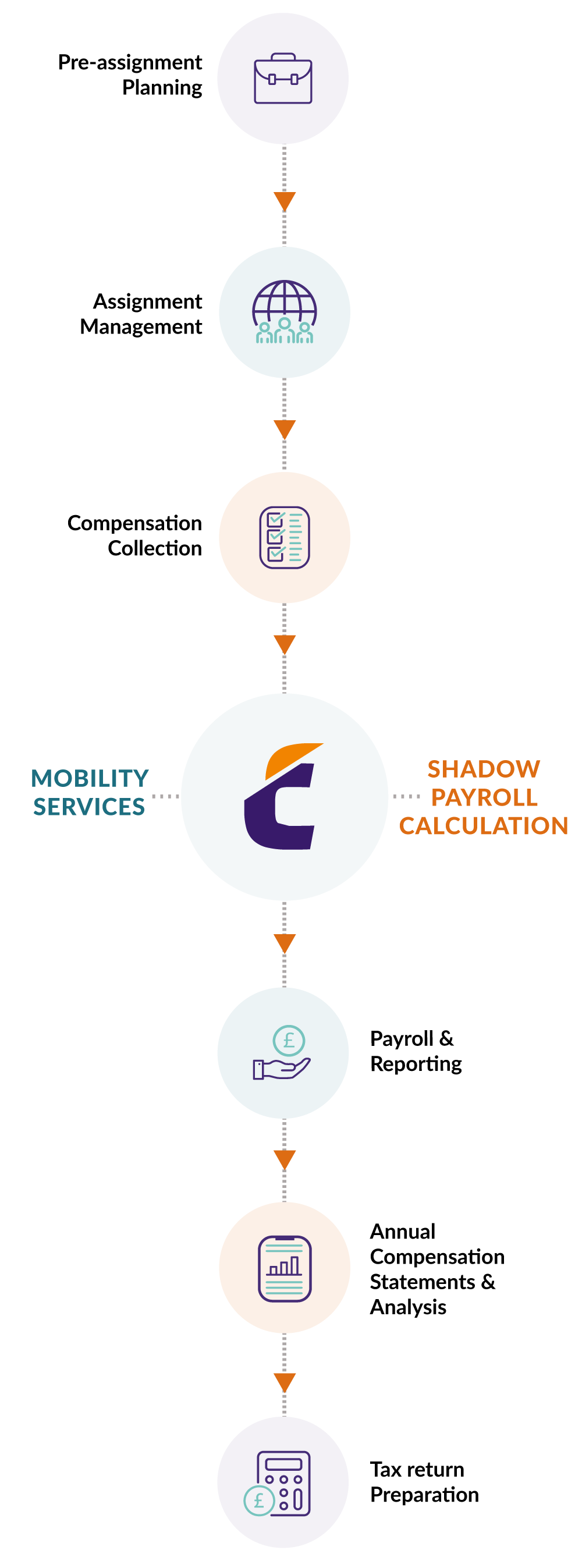

How Certino fits into the payroll process

A shared calculation layer for your expatriate payroll clients

Certino gives tax, payroll and mobility providers a single, global platform for owning expatriate tax and shadow payroll calculations across countries.

- Use Certino as a shared calculation layer upstream of payroll, rather than rebuilding country logic in spreadsheets or bespoke tools.

- Deliver consistent, payroll-ready expatriate tax and shadow payroll outputs across clients and jurisdictions.

- Reduce delivery risk and operational overhead while keeping full ownership of the client relationship.

Run shadow payroll with control, not complexity

Shadow payroll is complex by nature - multiple jurisdictions, moving tax rules, gross-ups, hypothetical tax and tight payroll deadlines.

- Bring expatriate tax and shadow payroll calculations into a single global platform, rather than relying on fragmented spreadsheets and hand-offs.

- Retain visibility and control over the calculations that drive payroll, without needing to build or maintain large in-house tax or payroll teams.

- Work more effectively with your existing tax, payroll or mobility providers by using a shared, trusted calculation layer across countries.

Certino is designed to sit alongside your advisor or payroll partner, helping them deliver accurate, consistent results while giving you confidence in the numbers.

What makes Certino different

- End-to-end calculation ownership

Certino provides a single source of truth for expatriate tax and shadow payroll calculations, rather than relying on fragmented spreadsheets and hand-offs. - Purpose-built for expatriate payroll

The platform is designed specifically for expatriate tax, hypothetical tax, gross-ups and shadow payroll — not adapted from domestic payroll or generic tax tools. - Consistency across countries and providers

The same calculation logic is applied regardless of jurisdiction, advisor or payroll provider, reducing interpretation risk and rework.

- Built to sit upstream of payroll

Certino supplies payroll-ready outputs that integrate cleanly into existing payroll and tax delivery models, rather than replacing them. - Designed for scale, not heroics

Monthly expatriate payroll runs can be delivered reliably without last-minute pressure, manual fixes or reliance on individual expertise. - Supports partner-led delivery

Certino strengthens the role of tax, payroll and mobility partners by giving them a shared calculation layer they can trust across clients.

We work on a country by-country basis, so delivering a single report in the Certino system and immediately providing shadow payroll results was very advantageous to us. This combination of benefits makes Certino unique as a shadow payroll provider.

Benjamin Mueller Senior Tax Specialist, Siemens GMS Tax