Featured

Case Study: Certino helps multinational company save 70% of operating costs by automating shadow payroll

Read how we worked with one of the world’s leading brands, taking them on a journey to automate their shadow payroll...

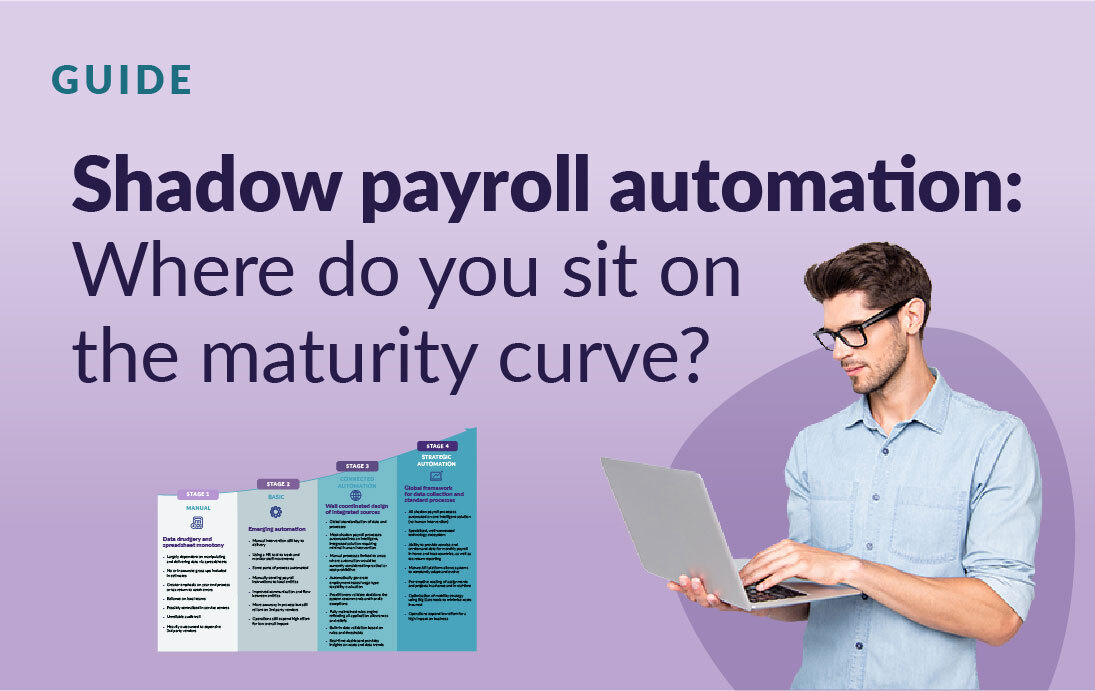

Shadow payroll automation: Where do you sit on the maturity curve?

In this article, we’ll step you through the different levels of shadow payroll maturity, help you to understand what...

The definitive guide to shadow payroll

A comprehensive guide about shadow payroll for global mobility, tax and HR teams managing an internationally mobile...

Shadow payroll: How to reduce international employment tax overpayments

It’s no secret that there’s a lot to consider when it comes to calculating international employment tax for shadow...

The digital transformation of shadow payroll

Digital transformation has been a hot topic for well over five years, enveloping every industry and seeping into every...

Centralise your shadow payroll tax calculations

Shadow payroll tax is a fragmented process. It’s difficult to track exactly what’s being paid where, by whom – and to...

Take the guesswork out of your international employee tax

International employee assignments are an expensive business. As a general rule of thumb, for whatever you pay in...

Minimise international employee tax payments through effective shadow payroll delivery

Employment tax is a major expense for any business involved with international employee assignments. Although it’s a...

Bring precision to your international employee cost accounting

How do the costs associated with your international employees get recorded in your books? Can you be absolutely sure...