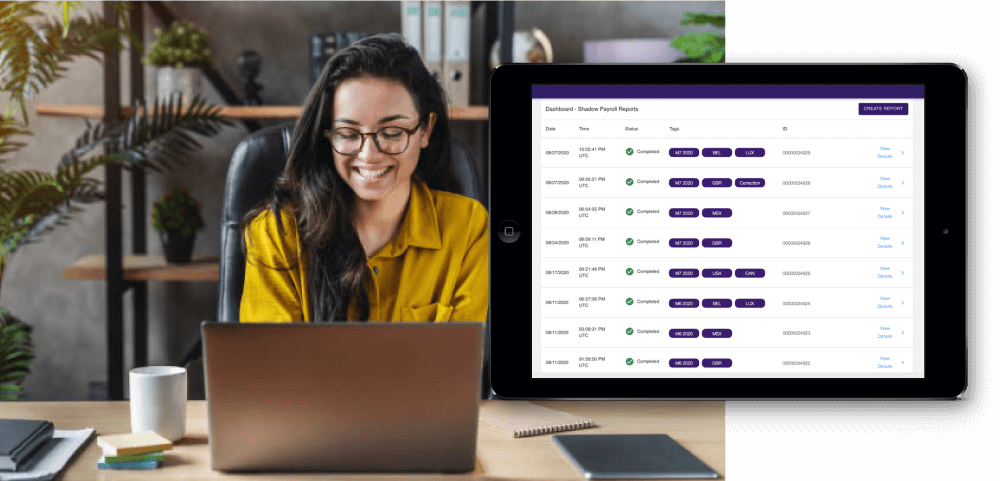

Certino helps multinational company save 70% of operating costs by automating shadow payroll

saving of overall operational costs

of monthly payroll filing on time

reduction in the need for filing amended W2 forms

Client Background

Our client, a Fortune 500 global technology

business, hires thousands of employees across the world to work on client projects in the USA. Each international employee creates a shadow payroll obligation to the USA tax authorities, which companies must address to remain compliant.

These tax obligations are urgent and often complex and when dealing with thousands of employees, can generate thousands of hours in administration.

The need for change

Managing large fluctuations of employee numbers across multiple geographies and entities while simultaneously ensuring accurate, timely payroll and tax processes can be a daunting challenge. It caused a major headache for this client’s global mobility team.

With high stakes shadow payroll deadlines and the inherent difficulty in obtaining real-time data, the very practical temptation

is to create a process based on estimated data and then, with great effort, to perform reconciliation and retroactive corrections

by fiscal year-end.

But the effort does not end there.

There is often a second wave of income tax reporting and corrections lasting well into the new year. Once the estimation process has been set in motion, it is generally regarded as quite difficult to change despite widely-known disadvantages such as a high level of effort, increased compliance risk, and substantial financial costs.

A shadow payroll system based on estimation

For almost a decade, this client’s USA shadow payroll was managed by monthly estimations. The problem with this is filing estimated shadow payroll figures with tax authorities requires reconciliation at year-end.

The earlier estimation-based payments to tax authorities are compared with actual payments to employees to identify over-and under-payments to the authorities. The variances are then used to "true up" the payments to the tax authorities using the assistance of an external tax provider.

This results in challenges requiring high administrative effort:

Late data collection in the home countries led to a monthly estimation process that required time intensive year-end corrections.

Overpayments were difficult to reclaim and this tied-up cash for months.

Difficulties meeting the deadlines for all employees increased the risk of late payment penalties.

Achieving tax compliance required substantial tax provider fees and interest payments.

"Queries from the fiscal authorities passed through many hands, and information was lost with each transfer. It was a nightmare to do all of the reconciliation within two months at the end of the year. We had to collect the data, review the data, send data to the provider, receive data from the provider, send the data to the payroll team, and verify that the payroll results are correct."

Fortune 500 Senior Tax Specialist

The first step to high quality, consistent shadow payroll calculations

To attain the highly desired goal of an efficient, timely shadow payroll based on actual payments, the first step the client made was to establish a core global mobility project team.

Create a dedicated, global project team

Assembling a global team is pivotal. It is essential that global colleagues truly understand and appreciate the particular challenges faced by the local team responding to host country tax authorities - and so we worked alongside them to provide guidance to get them up and running. Once the shared understanding was in place, their global team was ready to collaborate with the local team to redesign the shadow payroll process to better meet their needs.

- Automate the end-to-end shadow payroll process and digitalise HR processes with fast and efficient workflows

- Establish a single source for all international employee data, laying the groundwork for payroll and tax return processes

- Integration with global tax and payroll providers

- Strong long-term partnership with a focus on collaboration and continuous improvement

- IT secured, cloud-based solution and shared service approach

- Avoid costly fines and reduce compliance risk

The second step: build speed through automation

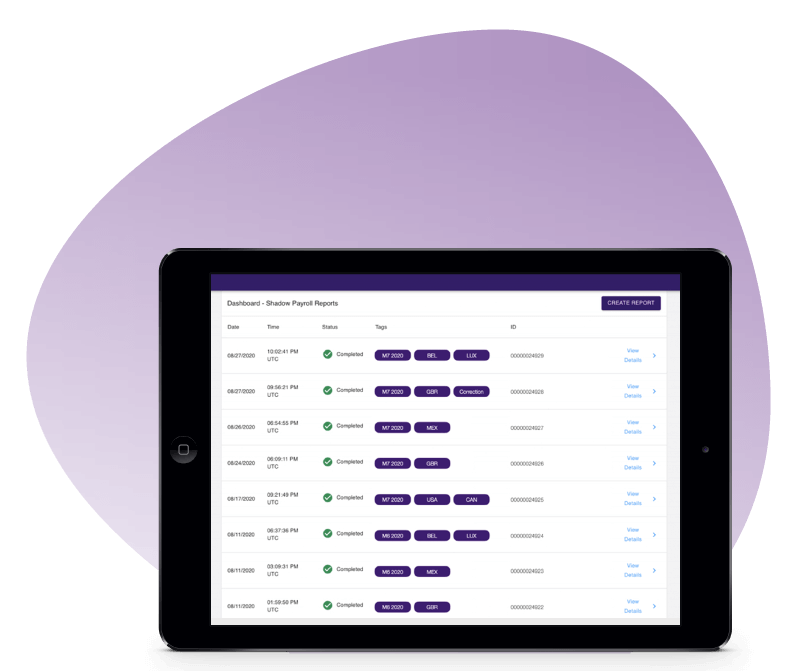

By 2020, the client had experience working alongside Certino. Using our shadow payroll automaton solution, they established efficient and accurate shadow payroll for a dozen countries - and they were ready to implement these shadow payroll processes on a much wider scale.

This would require a substantial shift in workstream responsibilities, but they were confident they would be successful given their team’s deep shadow payroll experience coupled with the power of our automated solution.

Replacing estimation processes

Capturing real-time data

First, they replaced estimation-based processes with a global data gathering process that would allow real-time data reporting. They worked with us to establish tax positions to create optimised tax payments supported by a detailed compensation analysis.

It is essential that the global team works collaboratively with local payroll teams to create clear, sustainable, responsive processes that minimally impact local payroll operations.

Payroll teams are first and foremost dedicated to meeting employee payment obligations, which can be a continual monthly challenge. Shadow payroll will always represent a secondary objective. Because shadow payroll is reported in arrears, it is altogether too common to fall behind in data gathering as it is prioritised behind traditional payroll.

The global team must both reinforce the strategic importance of high-performing shadow payroll to the company while also taking care to simplify the compensation reporting effort necessary for capturing real-time reporting.

Optimise the flow of data through the process

The clients’ payroll teams and our implementation team produced an interface that would allow the automated shadow payroll results to flow through its existing business management software. This could then be used for scheduled monthly filings with the tax authorities.

The data used in shadow payroll processes originate in a complicated assortment of payroll, HR information, and assignment tracking systems; even in manually maintained files. In an ideal world, the upstream process dispenses data in their standard output format, and it is the responsibility of the downstream process to map and manipulate the data for use in their processes.

Sometimes downstream systems lack the sophistication necessary to accommodate native format incoming data. The global team is responsible for reviewing the full end-to-end data flow to ensure that it is efficient

and as painless as possible.

And that’s where we come in. Certino's expertise is in the centralised, automated calculation of shadow payroll obligations. To facilitate the end-to-end flow, Certino validates and transforms incoming data from multiple systems into a standardised format used in its shadow payroll calculation engines.

The results are produced in one or more custom output formats per host country to best meet the downstream processing needs of payroll and tax provider teams. As the end-to-end processes become better defined and robust, ever-increasing automation can be introduced to drive efficiencies.

Working in collaboration with existing large accountancy firms

Collaboration is part of our DNA. We delight in engaging with talented professionals to design real-world solutions in real-time. This is foundational to our relationship with all our clients.

This client had a long-term relationship with 'Big 4' accountancy firms to provide a suite of global mobility tax services and some aspects of the shadow payroll process. Certino was introduced not as a replacement for the shadow payroll tax provider services but as a valued and complementary partner with very specific expertise in the automaton of shadow payroll calculations at a global scale.

Certino integrated into a discrete (and traditionally quite problematic) portion of the overall end-to-end shadow payroll process that in turn allowed this client and their tax provider to increase their focus on other activities where they contributed significant value.

Increased processing speed, greater data transparency, value-added specialisation supported by a harmonious, collaborative environment brought this client great success. It’s a win-win scenario for each partner in the shadow payroll process.

"We liked that Certino was flexible, fast and could adapt to our evolving needs."

Fortune 500 Global Mobility Director

Primary benefits of automated shadow payroll

Cost reduction

The legacy process was entirely reliant on the use of monthly estimates which required end-of-year shadow payroll reconciliation supported by an external tax provider. Individualised payroll correction for thousands of employees, with additional follow up in some cases, can be quite expensive.

The new shadow payroll process, supported by our automated calculations, allows for monthly filings using actual data. In the vast majority of cases, the need for year-end payroll reconciliation is eliminated.

A global internal tax team was brought in to handle routine assignment questions from tax authorities and business unit representatives. This modest additional cost was dwarfed by the substantial decrease in year-end payroll reconciliation fees.

Significant time savings

Even the W-2 amendment frequency greatly decreased. Each W-2 amendment carries a penalty; in previous years there might have been more than 500 amended W-2s, yet under the new process there were only three or four amended W-2s

Cost savings

Overall, the new shadow payroll process reduced end-to-end direct costs by approximately 70%.

Workload reduction

The new shadow payroll process is based on actual compensation data, limiting the end of year reconciliation to just a manageable small subset of employees that had compensation adjustments.

By dramatically decreasing the end of year workload, the teams can more easily bring greater focus to their recurring monthly shadow payroll operations, limited annual reconciliation activities, and assignment support.

Compliance

Paid taxes in respective months

USA’s tax authorities prefer to be paid in a timely manner within the respective months, which is much more easily achieved with actual shadow payroll processes rather than estimation-based processes.

Reduction in penalties

Greater compliance and alignment with the tax authorities has significantly reduced penalties, interest, amendments, and follow-up queries.

“The new process has given us greater ability to answer business colleagues’ questions as we now have all data in our records. Previously we would have to refer questions to our tax providers and often we would not receive a complete answer. Now we can answer our colleagues ourselves and show them the complete set of supporting figures.”

Fortune 500 Global Mobility Director

Secondary benefits of automated shadow payroll

USA team realignment

It is not enough to simply say that the workload decreased dramatically without mentioning what was accomplished with the time savings.

With shadow payroll being centralised globally, the USA mobility team based in other countries regained the time previously spent managing shadow payroll and could provide more value-added services to ongoing operations.

Eliminating overpayments, due to inaccurate estimates, released the payroll team from the tedious and time-intensive adjustment process of deleting payrolls and replacing them with corrected payrolls.

Greater internal tax knowledge

Shifting the process from a local team supported by an external tax provider to an internal global tax team was immeasurably helpful. The global tax specialists quickly expanded their knowledge of a USA specific country's tax topics, which allowed them to respond more quickly to tax authority and business unit requests and become less reliant on external resources.

Data transparency

Access to and understanding of data under the legacy process was fragmented and clouded by the ongoing need for reconciliations and amendments.

The new process granted the client access to end-to-end process data with clarity into the actual monthly costs broken down in detail instead of undifferentiated amounts.

Higher quality information exchange

With the legacy process, a request from a tax authority or business unit might be passed from a global mobility specialist to a global mobility senior tax specialist, then to an external tax provider representative, and finally to an external senior tax specialist. That’s a lot of hand-offs.

The response would eventually make a similar trip back to the requestor. Besides the loss of time with so many resources involved, the quality of information would degrade with each transition. And would be at risk of human-error.

By the time a requestor received a response, the supporting information may have degraded to the point where the response was incomplete or not sufficient to the specific needs of the request.

Shortening the chain between the requestor and the responder, the responses were more appropriate and comprehensive, eliminating the need for additional rounds of clarification.

Summary

An ongoing relationship

Our client was also delighted to discover many secondary benefits that provided better outcomes for business units, employees, tax authorities, and supporting payroll, global mobility, and tax teams. Having found a partner that understands how to simplify shadow payroll processes, they've continued to work with us to automate shadow payroll, reduce costs, and save significant time.

Key factors in our choice of Certino were a very important short turnaround time and a very smart way to produce results. We work on a country-by-country basis, so delivering a single report in the Certino system and immediately providing shadow payroll results was very advantageous to us. This combination of benefits makes Certino unique as a shadow payroll provider.