As the world begins its tentative steps to opening up to cross border business travel and assignments, it’s time for companies to prepare for the expected increase within employee global mobility.

The anticipated surge in travel together with a demand for different ways of working such as remote, and virtual assignments, means that many companies will have to rethink their travel and assignment policies – as well as the role of their global mobility department and the demands on it.

At the same time, while a few Governments are actively encouraging remote working with beneficial tax breaks, other countries will be thinking about increasing their revenues. We have already seen increases in top tax rates and tightening of compliance, not just from an employee perspective, but also from a corporate compliance perspective.

💡Top tip: As companies start to kick start their global mobility programs again, we believe it provides the perfect opportunity to review next steps with respect to shadow payroll.

We recently conducted our own research into companies’ key priorities for shadow payroll compliance. The research aimed to gather insight into how global mobility departments managed their shadow payroll process, especially post-pandemic and what’s needed for them to achieve their objectives for shadow payroll process and compliance.

>> See our previous article here to understand what shadow payroll is and when it might be required

Our exclusive research has revealed…

- Just under half (42%) deemed accuracy of the payroll calculations and filing as a major challenge.

- The majority of respondents (71%) rely on manual data gathering processes.

- Half (50%) of respondents would ideally like to centralise their data and processes in one place.

What key themes did we uncover?

Shadow payroll is no longer just required for long-term business travellers. With mobility moving in different and new ways with the rise in hybrid working, there comes an increased need for shadow payroll across all assignment types.

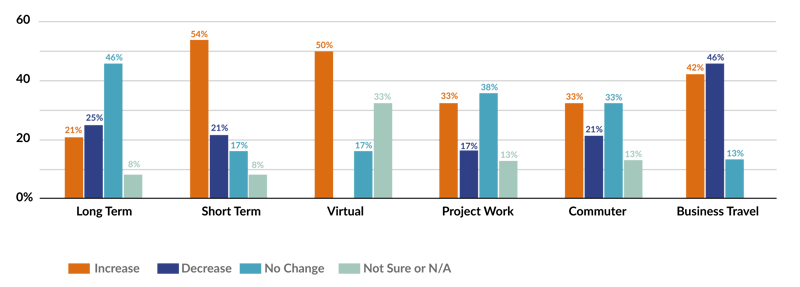

Q: How do you expect the following assignment types to change when business begins returning to normal (compared to pre-pandemic levels)?

Future demographics

Long-term assignments

Coming out of the pandemic, almost half (45%) of companies expect no change in the numbers of long-term assignments, 21% expect these to increase, and 25% expect these assignments to decrease.

Virtual assignments

Over 33% of respondents expect that virtual assignments will increase, which does tally with the expected decrease in long-term assignments by some companies.

Short-term assignments

While interestingly over half (54%) said they expect short-term assignments to increase, with 33% expecting an increase in project worker assignments.

"With the advent of COVID-19, virtual assignments increasing is a given. Many companies are now dealing with how to accurately track both work and physical locations of employees, then figuring out how to migrate compliance and PE risk when these do not align.”

Survey respondent.

Transitioning from home-based working

Once the pandemic is over, 42% of the companies surveyed expected an increase in travel over all types of assignment where shadow payroll compliance might be expected. The increase is associated with commencement of assignments that were on hold, increased projects as business confidence grows, and the need to get some business done face-to-face. This was certainly important for industries that need employees on location such as engineering.

"Long-term, I think we will see virtual assignments implemented in a more structured way, once companies figure out how to address the current concerns caused by the pandemic and develop solidified policies for ‘work from anywhere’ or virtual assignments.” `

Survey respondent.

Overall, 27% of our respondents expected there to be a decrease in assignments and travel generally in the future and this is likely due to better technologies, comfort with working remotely in teams, cost savings and lack of confidence in the ability to travel freely for a while yet.

Improving shadow payroll processes

Shadow payroll and ensuring global compliance can be a complex and difficult process to get right both in terms of timing and accuracy. Many processes and teams may be involved, and keeping on top of them means many man hours. It’s never been more important to work as efficiently and effectively as possible. Our research revealed the top three priorities for improving shadow payroll processes are:

- Top priority – reduce administration and cost: Almost two thirds (63%) stated that their main objective was to decrease administration to reduce the cost per assignee.

- Of those that had this as their main priority, 32% had it as the number one priority.

- Second priority – improve monthly filing accuracy: Just over half (54%) of respondents stated that accuracy of monthly filing, including gross ups, was in their top three priorities.

- Of those that responded, this was their top priority in only 15% of cases assumedly on the basis that if data gathering and process is right then the accuracy of calculations will follow.

- Third priority – centralise data and processes: Half (50%) of respondents would ideally like to centralise their data and processes in one place

- Of these, 50% stated this as the number one priority.

Priorities for shadow payroll in the next 12-24 months:

That’s why we are seeing more companies look to an automated approach to shadow payroll to stay on top of everything from tax gross-ups to year-end returns.

💡Top tip: It’s important for companies to start the journey to full shadow payroll automation by taking these first steps to consolidate processes and data to help reduce administration and cost, all while improving compliance.

>> Download our guide to benchmark your companies shadow payroll maturity

Payroll management

The majority of respondents (71%) rely on manual data gathering processes. This is not surprising given that some research participants did not have a large population where shadow payroll is administered, and therefore at this stage, it is likely manageable.

Just over a fifth (21%) of respondents settled payroll taxes through the filing of a tax return which inevitably will lead to some additional costs of accountancy fees, interest and penalties and increased administration. This is not ideal due to the possibility of scrutiny, but the recognition of a compliance requirement is a great first step to ensuring that taxes are being paid.

Less than a fifth (16%) of respondents said they use annual estimates and paid in installments - which can lead to under and overpayments of tax causing cash flow issues.

Methods of administering shadow payroll:

Moving to automation

8.3% of the respondents did have automated solutions in some but not all countries, so there was a combination of manual and automated processes in place. Only one company felt that they had managed to fully automate their shadow payroll process with a high degree of compliance.

This is a position that we have seen across our clients. Many entities do not have the capacity or the number of assignees to support a more automated approach, so the economies of scale are just not there.

It was clear from the results that the more automated the effort, the less overall cost per assignee per month. The average cost of running just the shadow payroll calculations per assignee per month was higher than expected and multiplied over the year (and, including the peripheral work), clearly demonstrating the case for streamlining processes and a technology solution.

In fact, when looking at the top three objectives for shadow payroll; cost, accuracy and reduced administration were the main drivers.

💡Top tip: Not every country is right for an automated solution due to costs, technology, or local practice. We can help you assess whether automation is worth the investment.

It was clear from the responses that the priorities do differ across companies, and this will depend on their current situation, the status of their shadow payroll maturity and the appetite to get the details right given the demands on global mobility teams at this time. There are other priorities rather than automation that may be paramount to achieving the main goals for shadow payroll and some of those will be to get the data collection working first to ensure shadow payroll can be filed accurately and on time.

>> Download our guide: Shadow Payroll Maturity Model. Benchmark your shadow payroll process and learn how to optimise it.

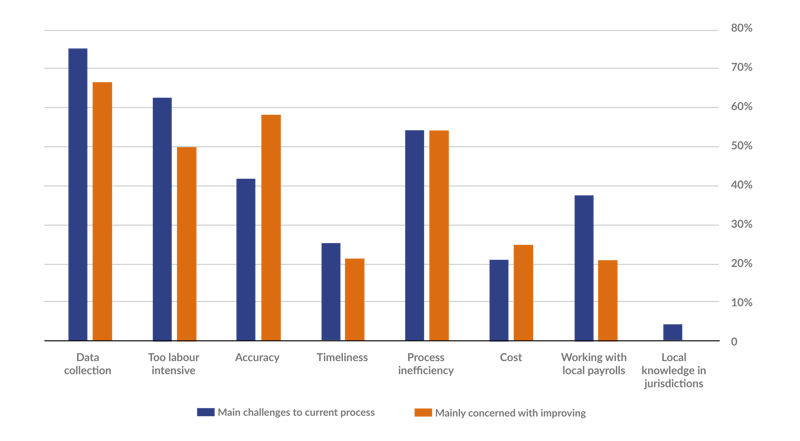

Main challenges with the current payroll process

Data management

The majority (75%) stated data collection was one of the main challenges in their current shadow payroll process. Data collection was a common theme throughout the survey, especially when companies are looking for a technology solution to resolve their shadow payroll challenges.

Q: What are the main challenges with your shadow payroll process?

62.5% of respondents noted their process is too labour intensive (which will also include data gathering) and it takes teams away from their main job for a process which could ideally be automated. In some cases, this was not a concern as yet. Tasks may be managed in a service centre and so do not directly impact the central teams, or it isn’t a major issue yet as assignee numbers needing shadow payroll are low.

Shadow payroll calculations

Almost half (42%) deemed accuracy of the payroll calculations and filing as a major challenge which is a concern given the compliance and cost implications.

It appears that companies are worried that the calculations produced by vendors and local payrolls do not actually reflect the correct amounts owed, leading to corrections having to be made via tax returns or year-end reconciliation.

Of course, this can lead to more work in the long run and costs from tax providers in auditing and updating the information - whether through the tax return filing or getting the payroll corrected at a later date.

Q: What one aspect of your current Shadow Payroll solution causes your company the most pain?

.png?width=800&name=wordcloud%20(1).png)

Technology and shadow payroll

Most shadow payroll administration issues can be solved by using a shadow payroll platform that integrates with existing tools . It allows companies to manage data in one place and use it to run accurate shadow payroll for multiple jurisdictions – and can be accessed globally.

Our research highlighted several key needs that are required for simple, cost-effective, and compliant shadow payroll processes:

- Automation of data collection

- Global payroll/compensation management

- Global payroll data warehouse

- Faster calculation time

💡Did you know? Certino’s shadow payroll platform helps to manage compensation gathering for accurate annual and monthly shadow payroll reporting and compliance, as well as cost modelling for expatriates and intercompany rebilling.

In Summary

When it comes to shadow payroll, understanding when a requirement might arise and automating shadow payroll data collection are important factors. However, a huge percentage (92%) of companies don’t yet have a fully automated solution in place, which could lead to costly compliance issues, not to mention the increased length of time and cost associated with a manual approach.

While longer-term trends remain difficult to predict, global mobility in 2021 is unlikely to return to pre-COVID-19 levels. However, we will continue to see a rise in newer types of mobility, including global remote workers and increased length of business travel trips -this was a clear pattern emerging in the research.

That’s why it’s really important to understand when a shadow payroll requirement might arise for these types of assignments. It’s more often than you may think.

Finally, while a number of uncertainties remain in the short-term, what is more certain, is that shadow payroll processes will need to continue to adapt due to the increased need for accurate and timely compliance, process efficiency and management of costs. That’s why bringing in automation sooner will be extremely valuable for the long-term.

About the research

We welcomed the opinion of 24 global mobility professionals. In line with the Global Mobility target demographic, we surveyed 71% headquartered in Europe, and 29% Americas, from a variety of industries.