Many companies need a global workforce and global mobility function. Companies are sending an increasing number of employees overseas for many reasons: from responding to opportunities in global production to improving customer sales, service, and growth. What’s more, the rapidly changing mobility landscape is creating a greater demand for personal mobility from employees.

If you’re considering sending an employee abroad, while retaining a home country employment contract, understanding shadow payroll is a must.

This article is intended to demystify the concept of shadow payroll by providing a high-level understanding of what it is and when it’s required.

What is shadow payroll?

A shadow payroll is a payroll that doesn’t physically pay the employee, rather it’s a mechanism that allows the employer to meet their local payroll tax payments and reporting obligations by replicating or “shadowing” the home payroll compensation reporting.

Shadow payroll is a method of calculating the appropriate tax and social security liabilities (in the host location) to be submitted to the host country authorities – while the employee continues to be paid from the home country payroll.

Essentially, the business entity or the payroll provider in the host country is required to “shadow” report all the payments and benefits that are paid in the home country. This also includes any other payments paid through relocation providers and/or paid directly in the host country.

It is important to ensure that the home country payroll amounts are translated into host currency. In addition, local tax rules and reliefs should be applied, and, if necessary, calculate the tax gross up, especially if the employee is guaranteed a net pay.

The description may sound simple enough, but it comes with its share of challenges depending on; the home and host locations of the employee, their role, their employment status, and where costs are charged for their work. It can be a complex process, which requires detailed knowledge and expertise making it crucial that companies are aware of any shadow payroll requirements when employees travel overseas – whether on a short or long-term basis.

Why is shadow payroll important?

As the expansion of the mobile workforce continues, getting the flow of data from multiple sources to home and host payrolls can be tricky, with data gaps and errors often the root cause of issues.

That’s why many companies are now looking to implement a robust global shadow payroll framework to support the conditions in assignment policies, as well as the complex reporting and tax position requirements mandated by the countries where employees are working.

Not only could it reduce the tax burden both in terms of the amount of tax actually payable, and the efficiency of the steps taken to get there, it can also significantly reduce employment tax overpayments and underpayments. What’s more, it could reduce audits and audit red flags, and ensure the right amount of tax is paid every time.

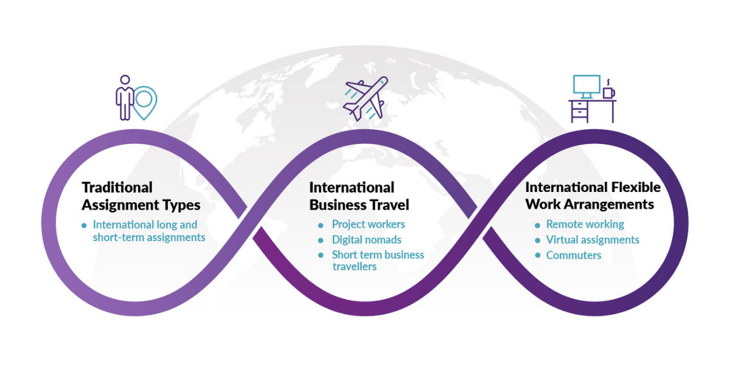

Key areas when a shadow payroll requirement might arise

While shadow payroll is most often used to manage assignees on long-and short-term assignments, shadow payroll processes can go much further. It can also cover; business travellers, project workers, and situations when employees require more flexibility in their work life – such as commuters, remote workers and virtual assignments.

1. International Traditional Assignment Types

International long and short-term assignments

It’s easy to see why a long-term assignment will require shadow payroll; these assignees usually remain on a home contract and their stay in the host location may span 2-3 years. Many will remain on home social security and benefits where possible, have additional allowances and taxable costs associated with their assignment and will be guaranteed a net salary. The assignment package plus any gross ups of tax (and possibly host social security) will all need to be reported via the host payroll.

Shadow payroll in these circumstances is usually a necessity and businesses need to be certain that the host payroll receives the correct taxable income to ensure accurate and timely reporting.

Short-term assignments by their nature can be more complicated for tax calculation and reporting given the assignee usually has taxable income liable to withholding in both the home and host locations.

If the assignees do have a payroll requirement in the host location (for example, not exempt through a tax treaty provision), then the need to accurately calculate the correct payroll in the host location is even more important. It’s possible that the assignee will continue to pay tax as usual in the home location, and the employer must meet the host liabilities not to burden the assignee with a cash flow problem. In such circumstances, shadow payroll is again a necessity to manage any tax protection policies in place.

2. International Business Travel

Project workers

A group of workers that may require adherence with host payroll requirements are individuals sent to a particular location to undertake a specific purpose, such as groups of employees on an engineering or IT project.

This group of individuals can be more complex to determine the payroll requirements – as the individuals may be contractors, from service centres, or temporary employees. Payroll requirements can also depend on a number of additional factors, such as who sponsored the work permit.

Employees will have a tendency to have a shadow payroll requirement if their costs are borne by the host company or there is an economic employer rule mandated in the host country tax rules. A specific policy to cover additional tax and social security costs should be in place with employers wishing to ensure that the costing of projects is correct. The need to have accurate and timely payroll is usually seen as a business requirement. Every case should be reviewed in advance, even when bidding for the project.

Digital Nomads

Project workers may also fall under the category of Digital Nomads. Digital Nomads are employees who tend not to remain in one location for long and could work in several countries throughout the year. These employees are unlikely to be a resident in any particular country and as such, tax treaties would not apply as a general rule. This leads to the possibility that the employee would be taxable on the days worked in each location and a payroll requirement may be required in each of those countries. Local legislation and days spent will drive the reporting and therefore the payroll requirements.

Some companies may use Global Employment Companies for these groups of employees to save costs and ease the burden of administration. This topic is complex and outside scope of this blog. Advice should be sought before proceeding with setting up such a structure.

These employees could also be considered to have flexible working arrangements if they are remote working from anywhere (see below).

Short term business travellers

This term refers to employees who travel overseas in the normal course of their job; typically those with regional or global responsibilities. The tracking and compliance of short-term business travellers has been a hot topic for many companies in recent years (pre-pandemic) to ensure compliance with local rules. Many Governments have introduced additional legislation regarding duties and time spent in their location, which could mean liabilities arise when none might have existed before.

With the costs of the pandemic, Governments may decide to be even more rigorous in enforcing current rules or introduce further rules to capture taxes from those that travel to their country if certain conditions apply (for example, introduce an economic employer rule such as Sweden did from 1 January 2021).

This is an area that is notoriously difficult to manage and track. This group of travellers may not be under the umbrella of the Global Mobility departments and separate processes need to be put in place to ensure immigration, social security and tax are reviewed on an ongoing basis for all, or at least some travel corridors, especially for senior employees.

Employers should expect increased scrutiny and compliance requirements for business travellers and have procedures in place to deal with any payroll reporting outside of the home location.

3. International Flexible Work Arrangements

Remote working

There has been an increased demand for remote working (in a country away from the normal work location country) whether on a part-time or a full-time basis. This trend is set to continue with employees preferring to work from home for some or all the time. In some cases, they may become Digital Nomads (see explanation above).

There is now a trend to implement HR policies to accommodate requests, as this way of working is here to stay. While the safety and wellbeing of employees remains key, care should be taken to not cause compliance issues for the company and the employee. It is possible that remote working could cause a tax burden for the individual in the working location, not to mention any corporate implications that may also arise.

Assuming the remote work is approved, shadow payroll could be required if the individual becomes resident in the host location AND salary is still paid from the home location.

It may be the individual’s responsibility to meet any tax burden as this is a personal choice. The mechanism for achieving that and deducting the right amount of taxes for the country combination concerned needs to be carefully thought through.

It should be noted that if costs remain in home location, there may then be a shadow payroll obligation there for any work days etc. In addition, there are a variety of other issues that will also need to be considered that are not payroll related.

Virtual Assignments

Virtual assignments are another form of remote working, but in reverse to the above; the employee remains in the home location and takes on duties for the host location.

Care should be taken with such arrangements with respect to tax compliance, and while the employee will mainly work in and be paid by the home location, the duties in the host location and the cross-charging of the employee costs may lead to compliance requirements both from a payroll and company perspective in the host location.

Commuters

While not new, especially inter-region, there may be an increase in demand for commuting for family reasons in the coming period. A large portion of the commuters in the EU region consists of frontier workers who commute across borders every day to go to work e.g. France/Switzerland. Special agreements are in place for these.

During the pandemic period, commuting has not been possible and individuals remained at their home to work, and extra agreements between countries were put in place to maintain the status quo. If individuals wish to continue to work wholly or in part from their home in the future, consideration should be given to whether a tax liability arises in their resident location and any payroll or reporting that may be necessary in the home as well as the host country – as conditions of the agreement may be breached.

Commuters that do not have such agreements in place e.g., the UK to Switzerland, need to consider whether their host country employer has a filing requirement, and whether payroll or additional reporting may be required. In normal times, if an individual is travelling regularly between their normal place of work and another location (especially a residence location), tax issues and payroll requirements may arise.

Final Thoughts

Compliance for a mobile workforce has always been a challenge. Now, work from anywhere, Brexit, government initiatives, and tax reliefs, all add layers of complexity. The location of employees, their activities, and their social security and taxation requirements will all take on greater emphasis.

As you can see, compliance with shadow payroll reporting requirements over the entire globally mobile workforce can quickly turn into a headache.

How Certino can help make shadow payroll simple

Certino can simplify the tax management of the globally mobile workforce through automation of the shadow payroll process. Our dedicated country tax engines designed specifically for shadow payroll purposes will provide fast and accurate results, including all necessary gross up of taxes.

Global Mobility teams that have an end-to-end global view of shadow payroll with automated processes in place will demonstrate the most adaptive and compliant solutions to the workforce planning questions of the future.

Working with a partner such as Certino, with vast experience in shadow payroll, supporting companies with their current populations and the growing complexities in payroll compliance for all different types of mobile employees can make the world of difference.

Learn more about how you can streamline and automate shadow payroll processes by booking a demo today.